Whether it is your daily, weekly or even monthly expenses, it is hugely vital to keep track of them lest things can go haywire. These days there are many apps which help you manage your expenses in an effective and simple way. With huge amount of economic pressures and ever rise in prices of necessary items, your budget can go for an off spin if you do not keep a tab on it. Keeping a check on expenditure is not at all an easy task.

If you use an Android smartphone you can download some very good apps to track and budget your expenses. Apps help you set monthly budget goals, track expenditure and ensure that you do not spend money on needless items.

Also read:

Fishing Apps for Android

Top 5 best Battery saving apps for Android

10 Best Android Weather widgets

Manage Your Daily Expenses

Given below are few of the popular Android apps to manage your daily expenses:

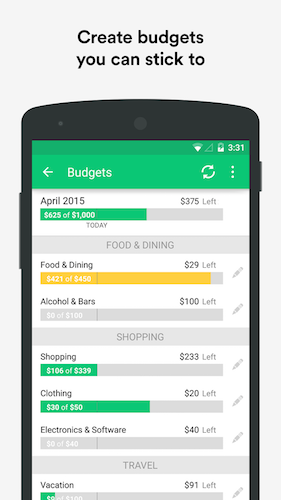

Mint Personal Finance and Money (Google Play rating is 4.5)

The free of cost Mint app enables you to spend in a smarter way and save better. You can put all your accounts, investments and cards at one place. This helps you keep track of your spending. It also creates a budget for you. You get bill reminders so that you do not have to pay late bill payment fees. You even get customized tips for cutting down fee and money saving. Also check credit score and learn ways to improve it.

Features of Mint

- Free installation and sign up

- Connect all your accounts securely

- Organizes expenses as well as financial accounts

- Builds budget to facilitate saving

- Protect data with 128-bit encryption as well as physical security used by banks

- Have your personal 4-digit PIN to access your account

- Charts as well as graphs to show your money spending trend

- Track your credit cards, cash and also check accounts

Moneyfy (Google Play Rating is 4.5)

Monefy is a wonderful money tacking app which just requires you to fill nothing just the expense amount. It is very quick and reliable. There is a Dropbox account which helps you synchronize date between different devices.

Features of Monefy

- Intuitive as well as easy to use user interface.

- No redundancy

- Add new records fast

- Handy widgets which can lock the screen

- See spending distribution on an informative chart

- Manage different categories

- Have your own Dropbox account

- Currency selection

- Use the budget mode

- Password protection

- Built- in calculator

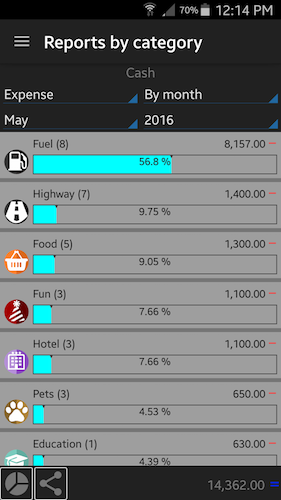

Daily Expenses (Google Play Rating is 4.5)

This is an application which is designed to put in order your income as well as expenses, money movements are recorded by date. You can have reports daily, weekly or even monthly.

Features of Daily Expenses

- Organizing expenses to have superior control over money

- Tracking of income as well as expenses

- Modify and delete records which you have created

- Password protect

- Creates backup of database to restore information if needed

- Available reports: daily, weekly, bi-weekly, monthly and yearly

- Available translations: Spanish, English, Portuguese, German, French, Russian, Chinese, Italian, Ukrainian, Indonesian.

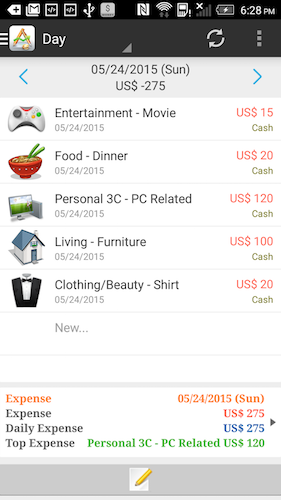

Andro Money (Google Play Rating is 4.5)

AndroMoney is a personal finance app which you can easily download on your phone. By making use of this app, you can manage your wealth in a better way. This easy to use app is powerful for daily accounting.

Features of Andro Money

- Cloud Storage facility

- Different currency with downloadable rates

- Number pad with calculation

- Easy Sync with devices

- Simple customized budgets

- Trend, Bar and Pie charts for Cash Flow and expense

- Password Protection for security

- Back up data to Mac Number/ Excel

- Multiple accounts as well as support account balance

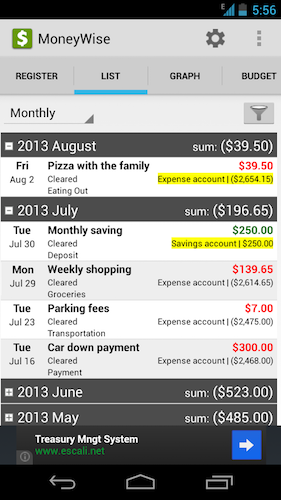

MoneyWise (Google Play rating is 4)

Moneywise is one of the best apps to keep track of daily expenses. You do not have to set up an account for this. It allows you to start directly by picking INR as the default currency. Create weekly, bi-weekly or monthly budget, and make use of filters such as income, expenditure, cleared and pending. This app bolsters multiple accounts, budgets and budget types. You can, do fast additions as well as deductions from accounts. Just set the budget and then add expenses to it. For the expenditure portion, there are many options such as deposit, food, rent, entertainment, , transportation, medical, shopping and so on.

Features of MoneyWise

- Organizes expenses and financial accounts

- Creates budget to facilitate saving

- Account transfer

- Payment Reminder

- 90 different currency symbols

- Analysis of expenditure with detailed charts and graphs

- Work offline

- Password protection to prevent unauthorized usage

- Paid version with features such as limitless number of account, transfer between accounts, recurring transactions

Author Bio

This Article is contributed by Saurabh Sharma for Girnarsoft – Leading mobile App Development Company offering all inclusive mobile app solutions with an option to hire dedicated android app developers to develop highly accurate and leveraging iOS apps. You can contact him at Facebook & Twitter.